Market Segmentation in the Fashion Industry: Understanding TAM & Business Scope with Case Studies

- Gaurav Mandal

- Jul 20, 2025

- 3 min read

The fashion industry is vast, but not every product is for every consumer. Successful fashion brands understand who they’re designing for and why. That’s where market segmentation, TAM (Total Addressable Market), and business scope research come into play.

In this blog, we break down key market segmentation models used in fashion, how to calculate TAM for different fashion business types, and the best ways to research your niche—with real-world Indian and global case studies.

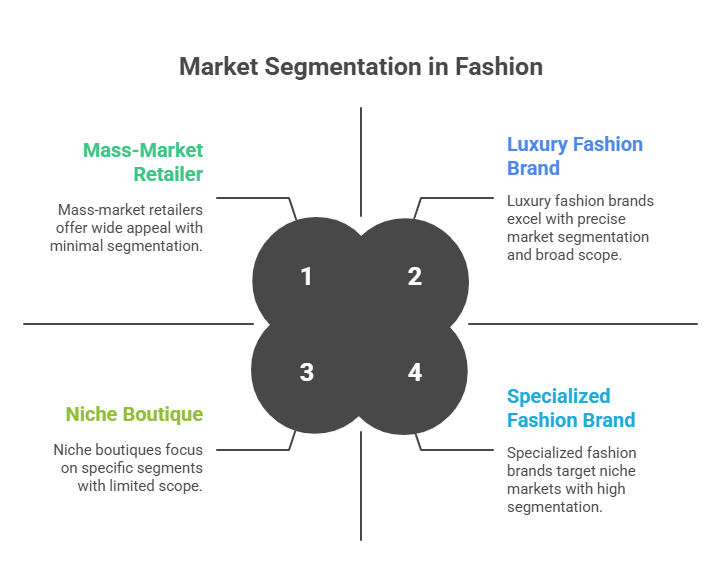

1. What is Market Segmentation in Fashion?

Market segmentation is the process of dividing a broad customer base into distinct groups with similar needs, behaviors, or characteristics—allowing you to create focused collections, pricing strategies, and marketing campaigns.

📊 Major Segmentation Types in Fashion:

Segmentation Type | Basis | Example in Fashion |

Demographic | Age, gender, income, education | Women’s plus-size wear (e.g., aLL by Pantaloons) |

Geographic | Region, climate, urban vs rural | Linen kurtas for South India (humid, warm) |

Psychographic | Lifestyle, values, personality | Boho-chic for creative millennials (e.g., Chumbak) |

Behavioral | Purchase habits, brand loyalty | Occasion-based buyers: bridalwear vs everyday |

Price-based | Mass, bridge, premium, luxury | FabIndia (mid-premium), Sabyasachi (luxury couture) |

2. Understanding TAM (Total Addressable Market)

TAM refers to the total revenue opportunity available if your product or service achieved 100% market share within your segment. It helps gauge the true scale of your fashion business idea.

TAM Formula:

TAM = Target Population × Buying Frequency × Average Selling Price

TAM Examples for Different Fashion Businesses:

Fashion Segment | TAM Estimation Logic |

Luxury Bridalwear | 3 lakh urban weddings × ₹1 lakh avg. bridal outfit = ₹3,000 Cr TAM |

D2C Athleisure (Unisex) | 10M urban fitness buyers × 2 outfits/year × ₹2,000 = ₹4,000 Cr TAM |

Ethnicwear for Tier 2 | 15M women × 3 outfits/year × ₹1,200 = ₹5,400 Cr TAM |

Plus Size Fashion | 5M customers × 5 pieces/year × ₹1,000 = ₹5,000 Cr TAM |

Export Garment Factory | 1,000 buyers × avg. 5,000 units/order × ₹350 FOB = ₹1,750 Cr TAM annually |

TAM helps validate whether your niche is scalable or not.

3. How to Research Business Scope in Fashion

Before investing in a collection, production, or a new business model, ask: Is there a real market?

Research Methods:

Method | How to Use It |

Google Trends | Compare interest in “lehenga” vs. “bridal saree” vs. “fusion kurta” |

Survey Tools | Use Typeform, Google Forms, or Instagram polls to test ideas |

Marketplace Insights | Use Nykaa Fashion, Ajio, Etsy filters to check popularity, price bands, reviews |

Keyword Research | Use tools like Ubersuggest or SEMrush to analyze fashion keyword volumes |

Competitor Study | Deep dive into what similar brands are offering, pricing, and marketing |

D2C Brand Reports | Use RedSeer, Bain, YourStory, or Blume reports to get TAM estimates and benchmarks |

4. Case Studies

Case Study 1: House of Masaba – Targeting Fashion-forward Millennials

Segmentation: Psychographic (bold, expressive, celebrity culture)

TAM Insight: Focused on 25–35 urban women looking for occasionwear with pop culture flair

Business Scope Method: Tapped into Instagram DMs and followers for feedback

Outcome: Multi-product expansion into cosmetics, lifestyle, and home

Case Study 2: Snitch – Affordable Menswear for Gen Z

Segmentation: Price-based + behavioral (frequent online shoppers, trend-driven)

TAM Estimation: Tier 1 & Tier 2 cities, men aged 18–30 buying 5–8 items/year

Business Scope Research: Observed gap in edgy streetwear under ₹1000

Outcome: 100 Cr+ turnover in under 3 years, now expanding internationally

Case Study 3: Okhai – Handcrafted Apparel for Conscious Consumers

Segmentation: Psychographic (socially conscious buyers), Demographic (women aged 28–45)

TAM View: Slow fashion + craft wear in urban Indian metros

Research Approach: Piloted SKUs in small drops, tracked returns and repeat buyers

Outcome: High repeat rate, strong D2C retention, growth via storytelling

Case Study 4: Blackberrys – Urban Indian Formalwear

Segmentation: Demographic (men aged 28–45), Geographic (urban working professionals)

TAM: ₹1,500 Cr+ Indian men’s formalwear market

Research: Mall retail data, footfall-to-conversion ratio

Outcome: Successful sub-brands in casuals and footwear

Case Study 5: Bunaai – Jaipur-Based Affordable Ethnicwear

Segmentation: Tier 2 female buyers (18–35), occasionwear shoppers

TAM: ~10M buyers × 3 festive purchases/year × ₹1500 avg. = ₹4,500 Cr TAM

Business Scope Research: Instagram growth + product feedback loops

Outcome: Bootstrapped into a ₹50 Cr D2C powerhouse

Conclusion: Design for a Defined Audience, Not for Everyone

Fashion success is not just about designing beautiful clothes—it’s about solving a specific fashion need for a specific audience.

Using segmentation models, validating your TAM, and researching your business scope helps you:

Avoid dead stock

Align with profitable price bands

Build loyal, high-intent customer communities

“In fashion, clarity beats creativity when it comes to building a business.”

Comments